By Jane Crombie, Board and Governance Specialist

There’s a lot of media about the need for companies and their boards to be more aware of their environmental, social and governance (ESG) responsibilities. However, in our experience many boards struggle to understand what ESG really means and what it requires in practice.

ESG criteria are a set of standards that socially conscious stakeholders consider when making investment and engagement decisions. ESG is a core strategic and risk management issue with implications for long-term business performance.

The terms sustainability and ESG are often used interchangeably. However, sustainability generally refers to the broad principle of providing for present needs without compromising the future, while the term ESG, favoured by capital markets, focuses on a set of metrics and their impact on risk-adjusted performance.

ESG factors include:

Environmental

- Climate change and carbon emissions

- Air and water contamination

- Waste management and recycling

- Deforestation

- Biodiversity and land use

Social

- Commitment to diversity and gender equality

- Human rights

- Supply chain labour standards

- Community relations

- Employee engagement

- Workplace Health and Safety

Governance

- Board composition, diversity, and independence

- Remuneration and incentive structures

- Anti-bribery and corruption policy

- Regulatory compliance

- Shareholder and stakeholder management

- Risk management and audit processes

The World Economic Forum recently issued a paper referencing ESG & D (data stewardship), suggesting the emerging area of Data Stewardship (cyber security, data privacy and ownership, and use of artificial intelligence and machine learning) is becoming a factor in its own right.

Consulting firm McKinsey believes a strong ESG proposition creates organisational value in five ways:

- Top line growth

- Cost reductions

- Reduced regulatory and legal intervention

- Employee productivity uplift

- Investment and asset optimisation

The case for ESG is still evolving, and stakeholders vary in their values and priorities. However, calls for ESG adoption are increasing due to political, regulatory, and investor pressure and this has accelerated during Covid-19. Trends and issues directors should consider include the following.

- ASIC refers specifically to climate change risk and disclosure in its regulatory guidelines, and large fund managers such as Blackrock have announced they will use their voting power to hold boards accountable for unmet expectations.

- Governments increasingly incorporate factors such as energy consumption, waste reduction, recycling, ethical work practices, and greenhouse gas emissions into procurement guidelines.

- Millennials are a powerful force behind the adoption of ESG across workplaces and institutions. Superannuation funds are applying pressure on their investment managers to adopt sustainable practices based on the expectations of younger members. As millennials move into C-Suite and board roles and receive inter-generational wealth transfers this trend will accelerate.

- Competition for capital, both debt and equity, makes ESG credentials an important consideration for boards and management seeking investment partners.

- Global initiatives to develop common ESG metrics and reporting will allow standardised comparison of organisational performance, risk management, and long-term value generation.

- Recent law reforms in countries such as Canada and the UK have redefined fiduciary duty to incorporate sustainable investment. As this trend accelerates, failure to integrate ESG issues will potentially become a failure of fiduciary duty.

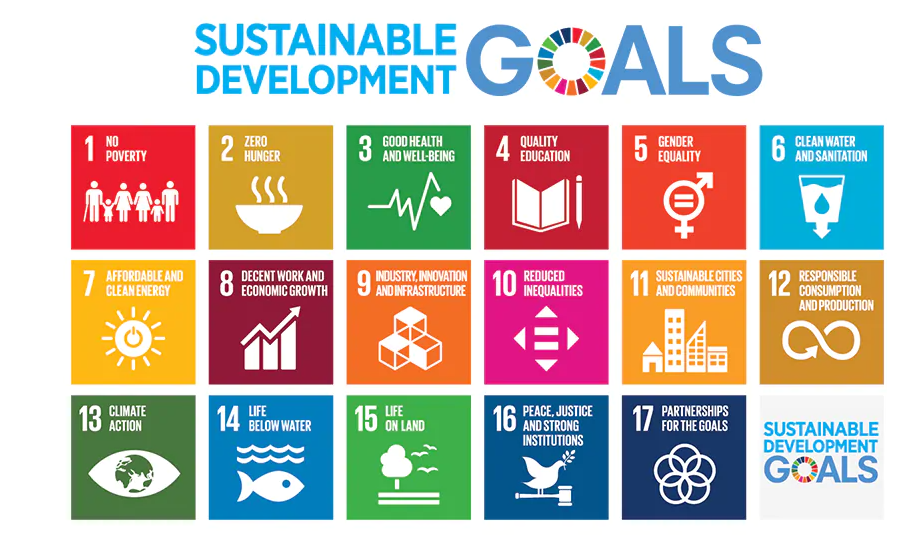

- There is increasing focus on how companies contribute to collective public priorities such as the UN Sustainable Development Goals (United Nations 2020):

Next steps

ESG is fast becoming a core strategic priority and reflects an organisation’s culture, values, and risk profile. ESG leadership may also improve access to capital and enhance growth opportunities. If it isn’t already on your board’s agenda, consider reflecting on how your board incorporates sustainability into long-term strategy and decision-making.

Directors Australia can assist boards with:

- Development of values-aligned sustainability governance and policy,

- Oversight of ESG disclosure and reporting frameworks,

- Workshops and resources to deepen director and executive understanding, and

- Incorporation of ESG factors into investment policies.

Jane has over 15 years’ experience leading portfolio construction, risk management, and investment analysis for superannuation, membership, and philanthropic organisations. She has expertise in evaluation of sustainable, green, and social impact investments, and development of ESG criteria within investment policies. In 2019, Jane graduated from an MBA at QUT, with her final thesis exploring ethical best practice for boards as competitive advantage.